Trusted by Large Insurers and Risk Managers

|

Award-winning performance, governance-first architecture, and omnichannel content delivery—all designed for regulated insurance environments. |

Launch Policy Pages, Campaigns & Updates in Days

Speed to market matters. Don’t let internal bottlenecks slow down business.

|

|

Built-In Compliance & Content Governance

Protect your brand and meet regulatory requirements with confidence.

|

|

Drag-and-Drop Editing Built for Insurance Teams

Update rates, benefits, and policy pages—no developers required.

|

|

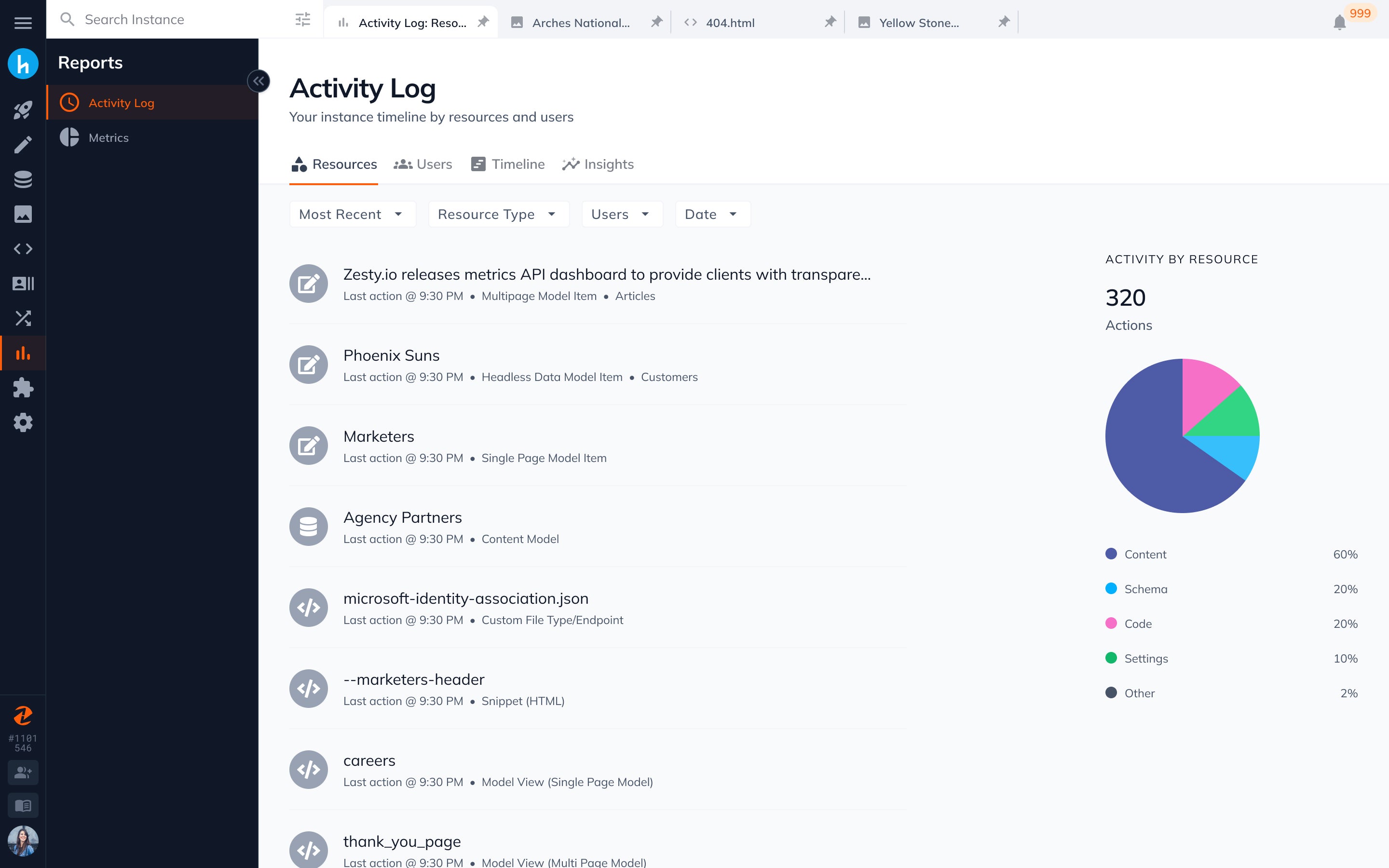

Connect with CRMs, CDPs & Legacy Core Systems

Break the silos between policyholder data and content delivery.

|

|

Free Insurance CMS Assessment

Get expert insight on your current content stack. In 20 minutes, we’ll walk you through how Content.One helps modern insurers streamline governance, improve digital speed, and reduce compliance risk.

[Book a Strategy Session]

[Request a Website & Content Audit]