From Branches to Global Brands: Built for Financial Scale

Trusted by banks, credit unions, and financial service leaders to deliver secure, scalable digital experiences—fast. Manage multi-site ecosystems, meet stringent compliance standards, and connect with customers across every market.

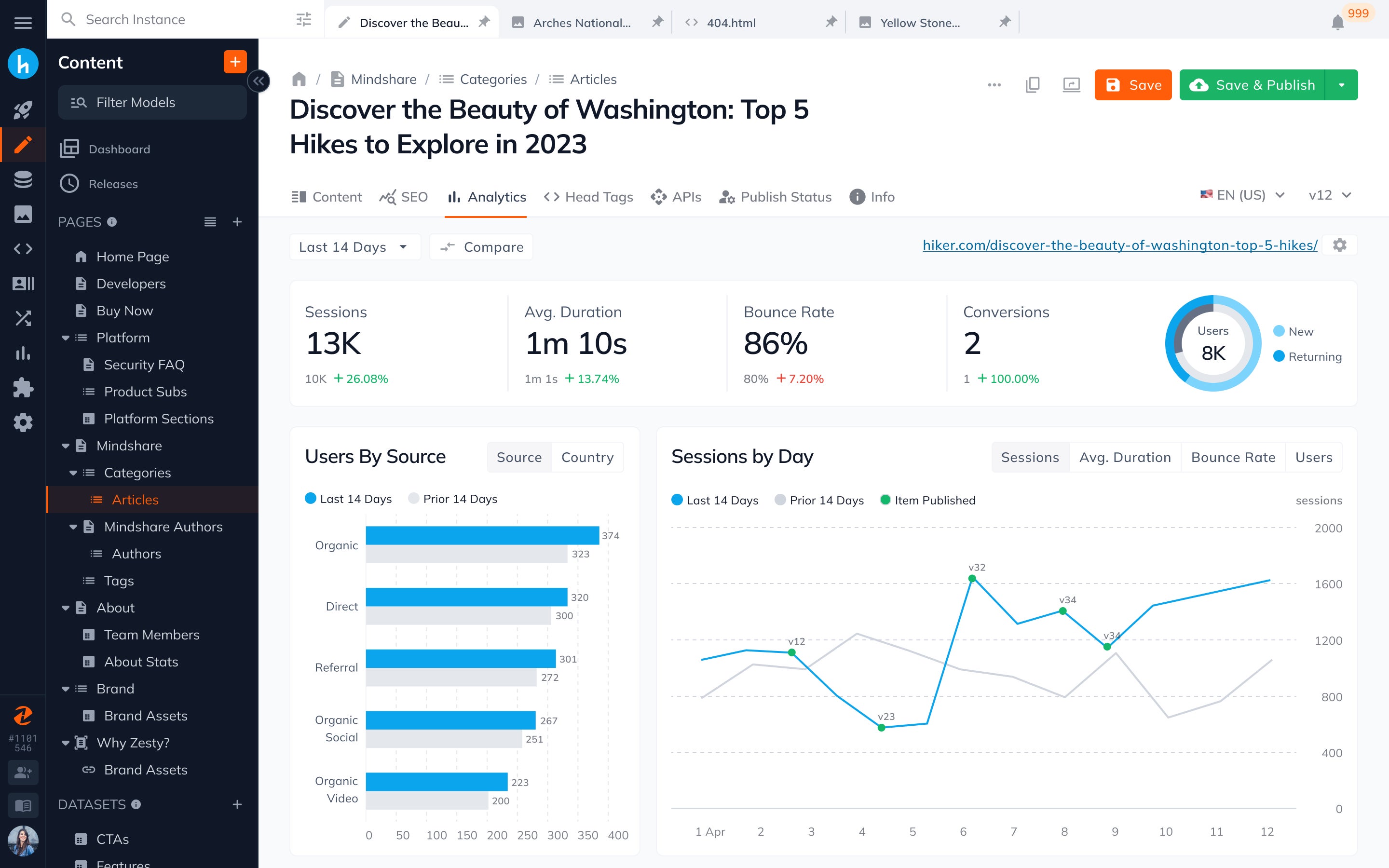

Instant Content Publishing for Rates, Notices & Offers

Time-sensitive updates shouldn’t sit in IT queues. Be first to market with timely content that stays compliant.

|

Launch new interest rates, disclosures, or promotional offers in real time.

|

|

|

Compliance-Ready by DesignSecurity and oversight are table stakes in financial services. Content.One delivers both—out of the box.

|

💡 Trusted by Financial Brands Focused on Agility & Trust

From regulated disclosures to dynamic offers, Content.One powers modern digital content for financial teams who can’t afford delays.

- [Book Demo]

Built for Multichannel Banking Experiences

Centrally manage content for your entire digital ecosystem.Omnichannel content with governance built in. Publish once, deliver everywhere—websites, mobile apps, secure portals

|

|

Why Financial Institutions Choose Content.One

|

✅ Launch campaigns, notices, and disclosures in real time ✅ Enforce compliance with full traceability ✅ Centralize control across business lines and regional teams ✅ Power omnichannel, personalized experiences—securely ✅ Integrate seamlessly into your modern or legacy tech stack |

Free Digital Audit for Financial Content Teams

Let’s talk about how your institution handles content today—and what’s holding it back. In just 20 minutes, we’ll help you outline the next steps toward speed, compliance, and control.

[Book Your Free Consultation]

[Request a Compliance & Content Workflow Review]